What I've Learned From Being the 'Broke Friend'

November 23, 2018

More often than not I have been the "broke" friend.

Growing up, I didn’t come from much, and I witnessed a lot of poor financial decisions made by those in my family. Their decisions influenced my understanding and patience with the process, as well as my mindset around building financial stability. Our "money scripts"—aka our core money beliefs and habits—develop in our childhood, without us even realizing it.

But to be honest, despite the innate generational hardship and mismanagement, if I had simply opened up and been honest with those around me regarding said financial struggles early on, I could have found a way out much sooner.

Being the broke friend can come in two forms: Either you’re consistently saying "no" to the point in which people get frustrated and don’t invite you out any more. Or, you suffer in silence–pinching pennies, pulling money from here and there in order to "make it work." This leads to you constantly playing catch up. I was the latter.

If I had simply opened up and been honest with those around me regarding said financial struggles early on, I could have found a way out much sooner.

I like spending time with my friends, traveling, eating at amazing restaurants and so forth. However, this all adds up, and quickly. Especially when living in NYC. My friends and I sometimes joke that a typical Friday night out is a minimum $100 dollars, and that it only goes up from there.

Now, I’ve heard extreme tales of those who’ve spent their very last penny and face eviction and debt collectors constantly. It never got that bad for me, I always made sure the bills got paid. But I could have certainly had a real savings by now and saved myself a lot of unnecessary stress.

A job change this year forced me to review and reset that relationship with money. About five months ago, I decided it was time I take a leap of faith and quit my job to pursue my own entrepreneurial ventures. I was finally making a good amount of money as a director of public relations, but of course, given my previous habits didn’t have much saved. Yet, I knew that something was pulling at me to make the jump now. I knew that if this was to be done, some changes needed to be made in order to see it through. I needed to seriously start budgeting and I also needed to open up to those around me when it came to financial matters to hold myself accountable.

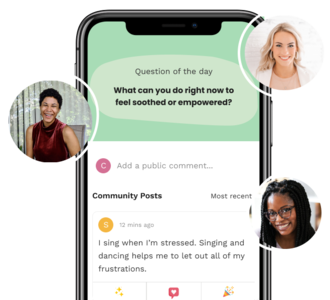

Today, I'm making the least amount of money in my entire adult career. Yet I feel much more confident about my spending habits and going out with friends than I ever have; mainly because when I go out now, I know I’ve got it. If I’m not out, I’m resting peacefully knowing I didn’t overextend myself for something I’d regret later. I've found my financial self-care routine, and it's empowering.

I am making the least amount of money in my entire adult career. Yet I feel much more confident about my spending habits and going out with friends than I ever have.

Here, some money self-care tactics I've learned along the way:

1. Make Your Budget Your BFF

A girlfriend of mine, who I also consider a mentor, has always been on me about making a budget to outline and manage my expenses. We both decided we were ready to quit our 9-5’s around the same time, and each time we spoke she followed up about whether or not I’d started my budget. Finally, I gave in and haven’t looked back since.

Whether it’s a budgeting app or a good ‘ole Excel document, outline all of your current expenses and begin by putting together a weekly or monthly budget for yourself.

Though it may be cringeworthy at first, after a few weeks of seeing it laid out and mindfully tracking spending, you’ll feel more comfortable opening up to others about what you can and cannot participate in.

2. It's All About Your Mindset

Being poor or broke can sometimes be a matter of mindset. Instead of saying, “I can’t, I’m broke” say something along the lines of “Thank you so much for inviting me, but right now it just isn’t in my budget.”

Not only will this exude maturity and self-control amongst your peers, but it’s also great for your psyche. I’m all about manifesting what I want out of life, so consistently saying how poor you are isn’t going to lead to riches. Instead, using a word like budgeting and saving speaks to a higher purpose in your efforts and lessens your anxiety when discussing with those around you.

3. Suggest Alternatives

It's very easy to feel isolated when in the process of rebuilding your finances, but it doesn’t have to be that way.

Once you’ve expressed to your friends that something they suggested is out of your budget, don’t end the conversation there. Suggest another fun alternative or reschedule for a time in which you’ll be more comfortable spending.

A lot of times, those closest to you will understand what you are going through and may not want to pressure you, so by suggesting alternatives it takes the edge off on both sides.

A lot of times, those closest to you will understand what you are going through.

Also, if you and your friends have a trip coming up and you’re worried about whether you can afford it, offer to step up and help in the planning process. That way you’ll have control over what it is you and your crew are doing and can regulate costs ahead of time.

4. Have a Conversation About Finances Early On

To be honest, the hardest person to discuss finances with was my boyfriend. Not because we aren’t close, but because I was intimidated–he is one of the most financially sound young people I know. He has made a number of great decisions to make sure he is and will always be secure.

As our relationship grew, we started traveling together, moved in with one another, and have begun discussing our lives together long term. So, the conversation on finances was inevitable.

Opening up to him about where my struggles were in terms of finances not only took a weight off my shoulders, but also built an accountability partner. Laying it all out there with him in the earlier stages of our relationship only brought us closer.

Sometimes it’s important that we start over and go back to the basics in order to move forward.

Sometimes it’s important that we start over and go back to the basics in order to move forward.

I feel this time of intentional budgeting and being much more mindful with my spending is setting me up for when I do begin making larger income again. Only this time, I’ll go about it the right way–with my tribe there cheering me on.

A version of this article originally appeared on blackgirlinom.

Read next: How Money's Affecting Your Happiness (and 3 Ways to Fix It)

Shine is supported by members like you. When you buy through links on our site, we may earn an affiliate commission. See our affiliate disclosure for more info.